New Approach to Budgeting

Penn State adopted a new data-driven budget model beginning with the 2023-24 and 2024-25 fiscal years to establish a more transparent and modern approach that helps the University achieve its mission, vision, and values.

How does the budget model work?

The model dynamically connects the activity of a specific unit—such as student headcount, student credit hours, and research expenditures—to their base budget allocation. The budget model has intentionally incorporated strategic funds to provide additional support for some units with activities and contributions that cannot be fully captured in those metrics. This funding aligns with feedback from deans, chancellors, administrative leaders, and financial officers during the development phase.

Using the model as a tool, allocations are determined for each unit and college, while Commonwealth Campus allocations will continue to be distributed to the Office of the Vice President for Commonwealth Campuses to allocate to individual campuses. In line with the previous budgeting process, each unit uses its allocation to determine its own budget, financial priorities, and roadmap.

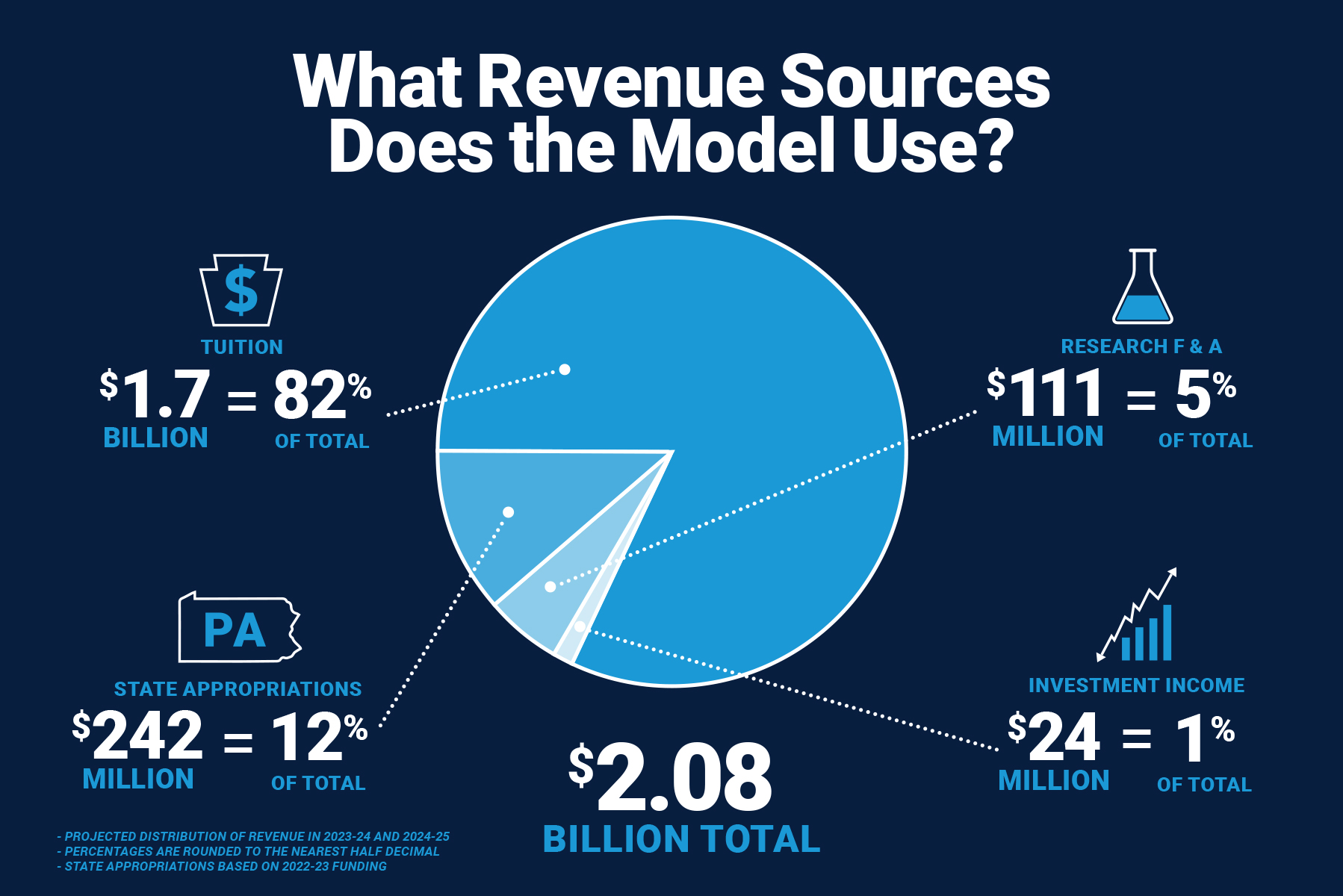

What revenue sources does the model use?

Within the model, various revenue sources are used to fund college, campus, and unit allocations. The Education and General Funds (E&G) Total Revenue included in the budget model is comprised primarily of four sources: student tuition ($1.7 billion), research facilities and administration (F&A) revenue ($111 million), state appropriations (using the 2022-2023 amount of $242 million; current legislation still pending), and investment income ($24 million).

*Note, other sources of revenue, such as those generated in the College of Medicine, Applied Research Lab, or student-initiated fees are included in the Board of Trustees approved total E&G revenues but are not included in the budget model. In addition, self-sustaining units like Athletics and Housing and Food Services are not funded through the E&G Total Revenue.

How will this revenue be distributed across the University?

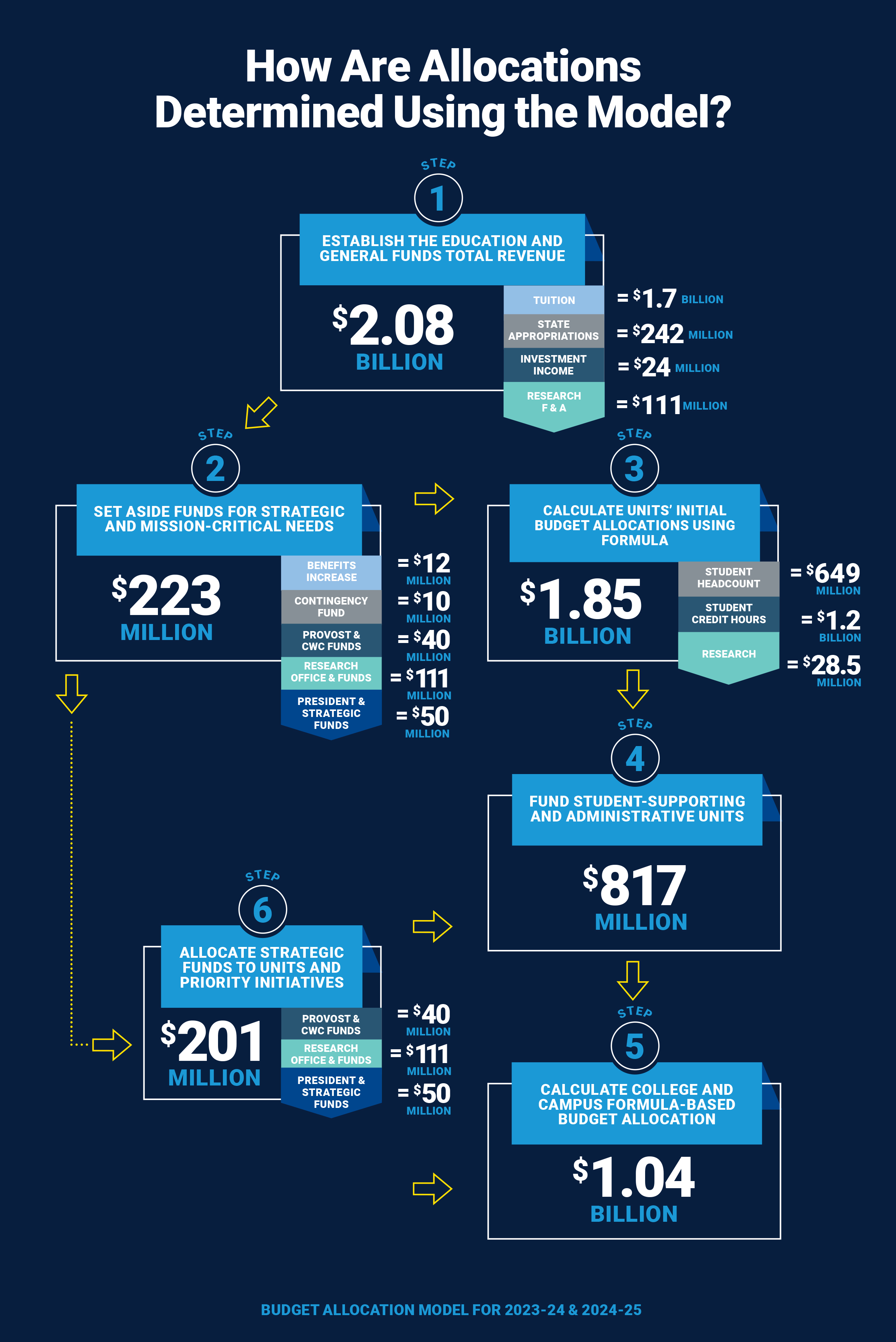

The following describes the high-level process of the budget model—beginning with the E&G Total Revenue and flowing down to individual units, which includes campus, college, and administrative budgets.

Step 1: Establish the Education and General Funds Total Revenue

The model’s base budget is comprised of revenue from tuition, state appropriations, research facilities and administrative (F&A) revenue, and investment income.

Step 2: Set aside funds for strategic and mission-critical needs

Because no model can capture the nuance and complexity of a university as diverse as Penn State, funds have been set aside to strategically invest across the institution in colleges, campuses, and units. Considering available funds, the University first determines the amount to use for strategic funds (Provost and Commonwealth Campus Funds and President and Strategic Investment Funds), Research Office & Funds, contingency funds, and benefit increases. These funds are allocated as needed and are not reflected in campus or college budgets until final approvals.

Step 3: Calculate units’ initial budget allocations

Once research, strategic, contingency funds, and benefits increases are set, the remaining revenue is used to determine college, campus, and academic unit allocations using a formula-based approach that accounts for activity within the unit, including student credit hours, student headcount, and research expenditures (F&A). The model uses these three factors to determine units’ initial base budget allocations.

When determining the tuition-based allocation for each college or campus, 65% accounts for student credit hours, with the remaining 35% attributed to student headcount. This allocation is then weighted based on the differing tuition rates for University Park colleges and Commonwealth Campuses. The allocation of the $28.5 million research incentive fund is calculated using a three-year average of F&A generating research expenditures.

Step 4: Fund student-supporting and administrative units

The budget model formula next calculates the percentage that academic units contribute from their initial base budget allocation to fund student-supporting and administrative units across the University. This amount is subtracted from units’ initial base allocations.

Step 5: Calculate college and campus formula-based budget allocation

Units receive a final allocation to use to develop and finalize their unit inidividual budgets.

Step 6: Allocate strategic funds to units and priority initiatives

With their budget allocations determined, unit executives discuss additional funding needs based on their areas’ strategic priorities with senior leadership, who determine and allocate any potential strategic funds that units, colleges and campuses will receive.

Together, these allocations represent the output of the E&G Total Revenue, an expected $2.08 billion in 2023-24. Budget executives continue to work with senior leadership to develop and finalize their unit budgets, and the Budget and Finance Office prepares the aggregated University budget for approval by the Board of Trustees.

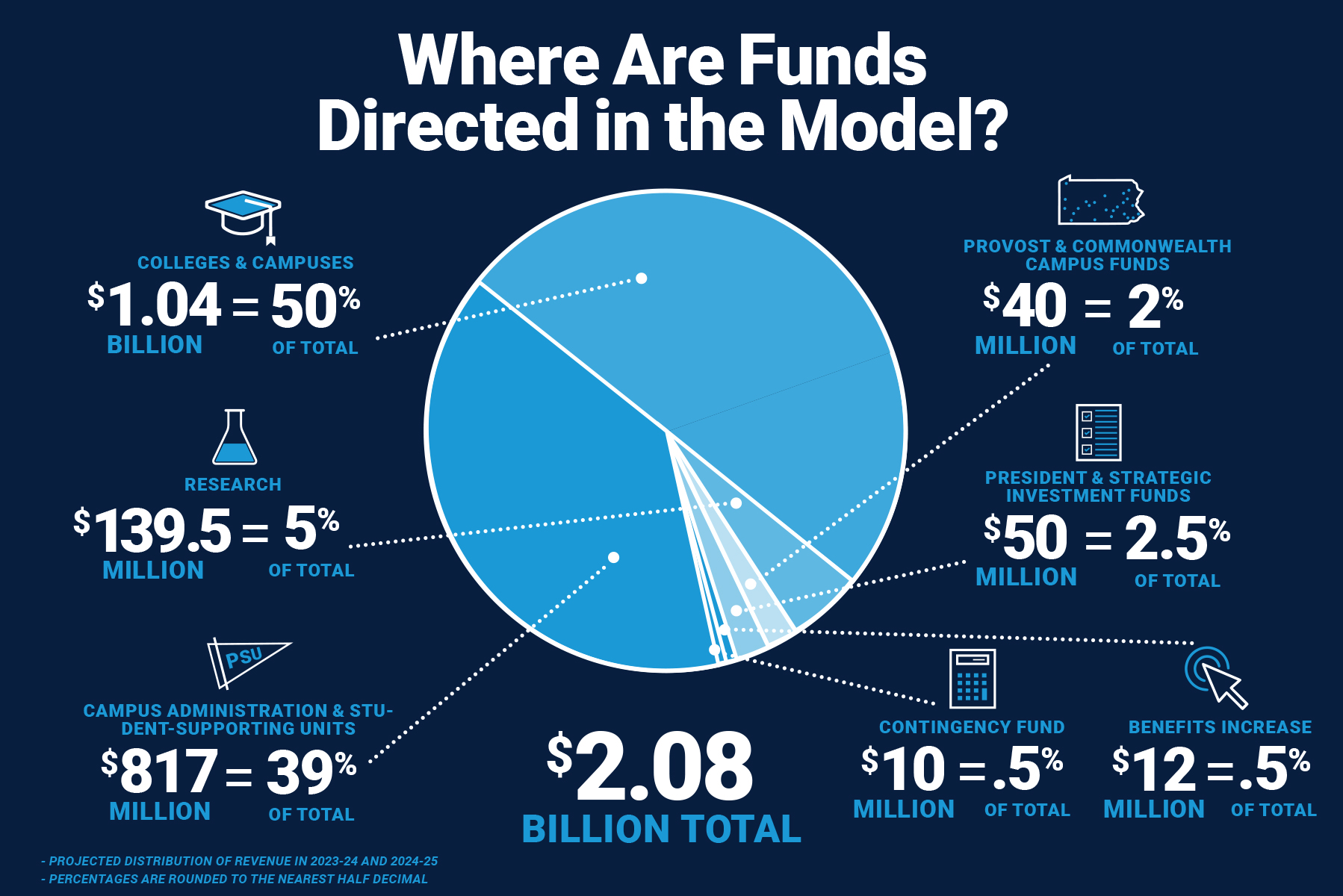

What is the amount of revenue distributed to each budget?

The following is a breakdown of the budget model total revenue and where funds, including those designated for strategic and research use, are ultimately directed within the model for 2023-24 and 2024-25.

At the University level, the budget is directed toward these avenues: campus administration and student supporting units ($817 million), research ($139.5 million), colleges and campuses ($1.04 billion), provost and commonwealth campus funds ($40 million), president and strategic investment funds ($50 million), contingency funds ($10 million), and benefits increase ($12 million).

Glossary of Terms

Benefits increase

Funds to support cost increases for employee benefits, such as health care and retirement.

Cap Model Calculate Increase

A cap or limit placed on the allocation increase a college or campus could receive under the budget model. Amounts over the cap redistributed to other colleges/campuses.

Carryforward

Unspent funds from the prior fiscal year available to spend in the next fiscal year.

Contingency fund

For emergencies to cover unexpected costs across the University.

Education and General Funds (E&G) Total Revenue

Comprised of four sources: student tuition, research F&A, state appropriations, and investment income. Note, other sources of revenue, such as those generated in the College of Medicine, Applied Research Lab, or student-initiated fees are included in the Board of Trustees approved total E&G revenues but are not included in the budget model.

F&A Generating Research Allocation

$28.5 million research allocation to colleges and campuses based on the three-year average of facilities and administration-producing research, instruction and outreach/public service.

FY24

Fiscal year 2023-24, starting July 1, 2023, through June 30, 2024.

FY25

Fiscal year 2024-25, starting July 1, 2024, through June 30, 2025.

FY26

Fiscal year 2025-26, starting July 1, 2024, through June 30, 2026.

Hold Harmless / (Limit) Model Calculated Increase

A capped decrease or increase to the model-calculated budget allocation.

Investment income

Interest earned from invested funds, generally short-term, to generate income to support the E&G budget.

Research facilities and administration (F&A) revenue

Portion of externally funded research grants designated to support University overhead. An equivalent amount of all research F&A revenue received is allocated for research needs.

Research Office and Funds

Support for research incentive funds, faculty start-up packages, strategic research needs, institute co-hires, and matching cost share.

State appropriations

General support from the commonwealth to help off-set the cost of tuition for Pennsylvania resident students. The included number is based on the 2022-23 appropriation, as the 2023-24 appropriation has not been set.

Strategic funds

Resources provided to a college, campus, administrative or student support unit by the provost, president or other senior leader for strategic needs or priorities and to provide resources for costs that aren't captured fully in the budget model.

Student credit hours

The amount of classwork credits that are being earned in each college or campus each year.

Student headcount

The number of degree-seeking students enrolled in a college or campus.

Student supporting and administrative units

Functions and offices of the University that directly support the student experience, such as Undergraduate Education and Student Affairs, and those that administratively enable the educational mission of the University, such as Finance and Business. Each academic unit contributes the same percentage to fund student-supporting and administrative funds.

Subvention

An operating subsidy provided to a college or campus at the discretion of University leadership to provide resources for costs that aren't captured fully in the budget model. This additional financial support is held in the budget model for allocation by the provost and/or vice president for Commonwealth Campuses.